VERIFY THESE ASSUMPTIONS BEFORE YOU INVEST IN A SYNDICATION

Last week Harland talked about getting to know the syndicators.

This week is about understanding the property. More specifically, the plan for the property.

Many investments are expected to make significant returns. But the assumptions that enable the returns can be overstated. If they are not conservative or in agreement with the market, then investors can be left disappointed. And the syndicators, or general partners, can find themselves struggling to make the property perform as predicted.

Here is the most common assumption that is misunderstood.

Inflation.

Why does this matter? We’ll take a look at three significant areas. Sale price, leverage, and rent increases.

ONE. SALE PRICE

Many investors consider the internal rate of return, or IRR, as a key metric when considering potential investments. It is composed of cash flows from the initial investment to the final return. IRR accounts for when the investment is made and when returns are received throughout the life of the investment, not just the total return.

If you have looked at a few syndication offerings you have probably seen both a preferred return paid regularly, maybe quarterly, and a total expected average return over the life of the investment. The total expected average may have been twice the preferred return. Why is this?

Because much of the gain is realized at the time of sale.

Let’s consider a typical Value Add scenario. Following purchase, improvements are made to the property and/or management and rents are increased to market rate. Then the property may be held for several years while investors enjoy annual rent increases which are in line with inflation. For simplicity of our discussion, let’s assume that the improvements are accomplished in the first year.

What happens to a property value if held for 4 years with inflation at 3-percent? It grows in value a little over 12-percent.

What if we assume inflation is 4-percent over the four years? Then growth would be a little over 17-percent.

Can you see how a small change in our assumption about inflation makes a noticeable change in the overall return?

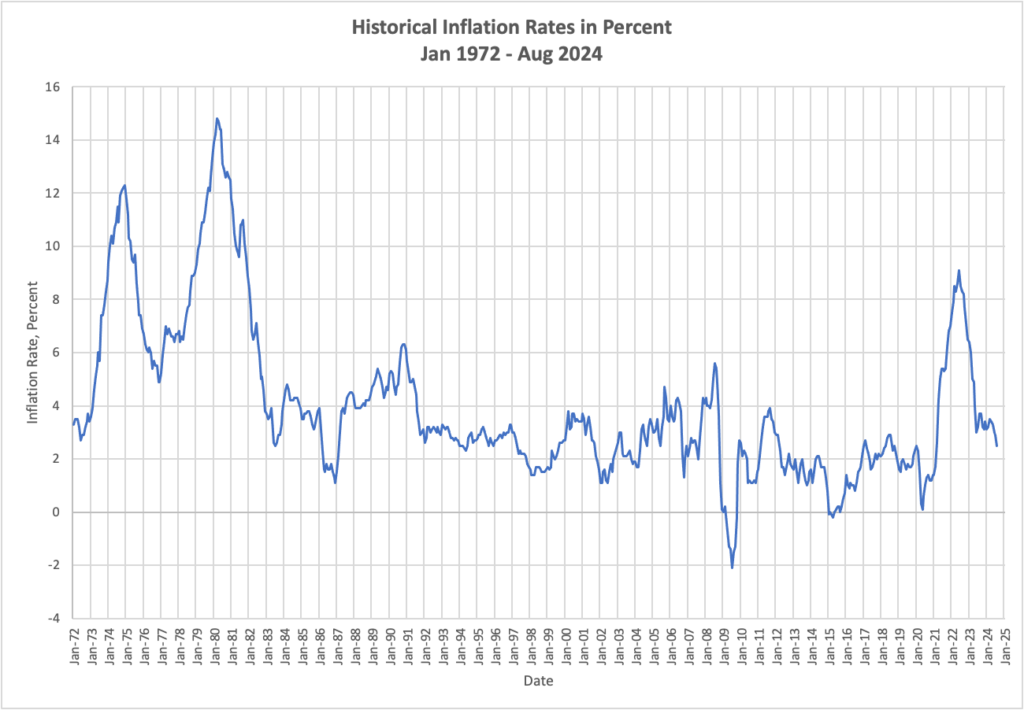

What number should we be using for inflation? The chart below was created using data from https://www.usinflationcalculator.com/inflation/current-inflation-rates/.

Inflation has averaged 3-4 percent over the last 60 years. That includes periods when inflation was high, such as late 1970s, early 1980s and early 2020s. It also includes periods when inflation was low, such as the 2010s.

When comparing investments, it’s important to recognize the difference inflation can make when projecting potential returns.

TWO. LEVERAGE

Maybe the 5-percent difference above doesn’t look like much. Then we remember that most commercial investments are purchased with leverage. Just like with your personal residence, a small down payment can allow you to enjoy more equity quickly. Have you experienced this with your own home? How much did you put down to buy your home? How much equity do you have now?

We use leverage to multiply our gains.

If we bought a property with 50-percent down, we would enjoy the equity build-up due to inflation but with only half the investment. So the return due to a 3-percent inflation rate would be 6-percent annually instead of 3-percent.

What if we could purchase our investment with only 33-percent down? The annual equity build-up from inflation is the same when measured in dollars, while leverage increases our return from inflation to 9-percent annually.

What if we now assumed inflation to be 4-percent with the same leverage, 33-percent down? Our annual return from inflation would be 12-percent.

The difference can get larger when compounded over several years.

Can you see where a small assumption about inflation, when combined with leverage, can lead to significantly higher expectations?

THREE. RENTAL INCREASES

Rental increases are also driven by inflation. They are also highly affected by local supply and demand.

Many landlords have not maintained rent increases with the market. Others have. The significant increases over the last few years have led many investors to believe they can keep raising rents at a similar rate. Or at least at a rate higher than normal.

It is difficult to predict what the supply and demand will look like several years from now. But we can look at current trends in a given market and know that the market will try to stabilize itself.

We might assume that a Value-Add investment can achieve market rents in a year or two as units are renovated and leases renewed at new market rates. Once those rates are achieved, how much can we realistically expect the rents to increase every year?

This is where we might expect rent increases to follow normal inflation rates. If the projections are for higher increases after a property is stabilized then I would want to know why. Is the demand in the local market higher than what can be supplied by new developers? Will that demand continue after your investment is stabilized?

FINAL THOUGHTS

It is difficult to accurately predict inflation. However, we can use leverage with our real estate investments to provide more than a hedge against inflation. The combination can produce significantly higher returns.

When we compare investments, we need to look at the inflation assumptions so that we are comparing apples to apples. No two investments are the same. But taking the wrong assumptions about inflation for granted can lead us to the wrong conclusions for what our investments will achieve.

If we understand how to be conservative with our assumptions about inflation and the market then we increase the odds of making successful investments. Inflation then works in our favor as it is leveraged for our overall return.

HELP US GET TO KNOW YOU BETTER.

Attune Investments provides a better return for our investors. And we make a positive impact on people’s lives and our world.

If you want to learn more about how others invest with us, we invite you to join our club and talk with us. See below.

Through the power of a syndication partnership with other investors like you, working with managing partners experienced in apartment complexes, you can own multifamily assets.

CONNECT WITH US. Subscribe to our BLOG, subscribing now can increase your knowledge and comfort with this asset class. It’s free.

We publish an article every week.

Take one more step: Become a member of our ATTUNE INVESTORS CLUB, which gives you more personal access to us. JOIN HERE.

Mike is a retired aerospace engineer with a passion for real estate investing and teaching financial literacy. He lives with his wife in Daytona Beach, Florida.