Financial Independence, Retire Early

Click here to watch the video, or keep reading below for the transcript.

SETTING MILESTONES ON THE F.I.R.E. JOURNEY

Financial Independence, Retire Early

Transcript

Mike

Hi, I’m Mike Jacobson and with me is Harland Merriam. Together we are Attune Investments and today we are talking about F.I.R.E., Financial Independence, Retire Early. This is our fourth video on F.I.R.E.

Harland

Yeah, one of the challenges I’m seeing, Mike, is we’re doing these videos and we have several more to do, is that F.I.R.E. takes a long time. Not just recording these videos and sharing them, but actually achieving that financial independence. So, what are we going to talk about?

Mike

Today we are talking about milestones. The goal at the end of our journey is financial independence, and actually that will start a new journey. But it is a long way. It’s like running a marathon or making it through school. Look at, I mean, you have 12 years just to get out of high school and then some people go on to college, or others go on to get advanced degrees. That can be many years and we need some milestones along the way.

Harland

Yes, we do. And let’s look at that, a picture here. With some of that college kind of stuff that’s going on there in life. You know, getting through school, even just getting through high school. I mean, there are classes to take and semesters to get through in the years to get through school until you finally get that diploma there. It really has some challenges.

What’s a milestone?

WHAT ARE MILESTONES?

Mike

A milestone is something you can feel good about achieving, and it’s encouraging because you feel a sense of progress on the journey.

Harland

Ah, like this guy who is making it up the stairs. Look at that smile on his face there. I’ve got a video here that Mike shared with me. I want to share it with you guys, if I can. Talk about this, Mike.

Mike

Yeah, this is our daughter running a Disney marathon and she enjoyed having support along the way. Sometimes we would find out where she was going to be passing by so we would wait at some of those locations and wave to her and give her high fives. Some people hold up signs and that was something a lot of people do for the runners. And it’s not just about the people you know, but people are out there supporting everybody who’s running. And that’s because they are out there achieving something. In that milestone is something that helps keep them running, keeps them going.

Harland

But it does keep them going. I remember running the Army 10 Miler a number of years ago. And I had in my mind set some milestones on the race I wanted to see. The White House and the Capitol building and the Smithsonian, and come back around and see some of the memorials, and then get across the bridge, back over to the Pentagon itself. Yeah, milestones are important.

Mike

That’s right. Some of them you know ahead of time and then there are others you recognize when you go by and they’re just exciting. It’s like, wow, that that is amazing.

Harland

Yeah. And you, you make those milestones or you finish them and you need to be celebrating, don’t you?

CELEBRATE!

Mike

That’s right. So some of the ways we like to celebrate, not during a race, but after a race, or it might be when we hit a milestone on our financial journey to F.I.R.E. Yes. Like if we hit a dollar mark such as a certain percentage of our income. Or the portfolio grows to a certain level. Nominal values. Then we might go out to eat and have a dinner to celebrate, or you might buy yourself something small and memorable. Maybe some trophy or picture to put up on the wall to reward yourself.

Harland

Yeah, you might. You might sign up for a 5K as your reward for yourself. I don’t know what. You are with that, but rewarding is a very important part of this. But we’ve got a couple of milestones we’ll be sharing with you that you might consider along the way. One of those is to actually develop a plan for yourself, for your achieving that financial independence. Next week we’ll get into that some and actually sign a kind of a document there that I’ll commit to this plan.

Mike

That’s right. And most people already know that one of the keys to success is having a written plan and that it needs to be simple. The simpler the plan, the better. Let’s keep it simple. And so some of the ideas we thought about are celebrating your first week on F.I.R.E or being on F.I.R.E., or making your first investment, making investments along the way. You know when you make that first investment, so celebrate.

Harland

Yeah. And there are some big ones along the way. Maybe buying that first investment property, getting into real estate. And doing that might be one of the milestones you want to put on your plan to celebrate down the way there somewhere.

SET YOUR MILESTONES

Mike

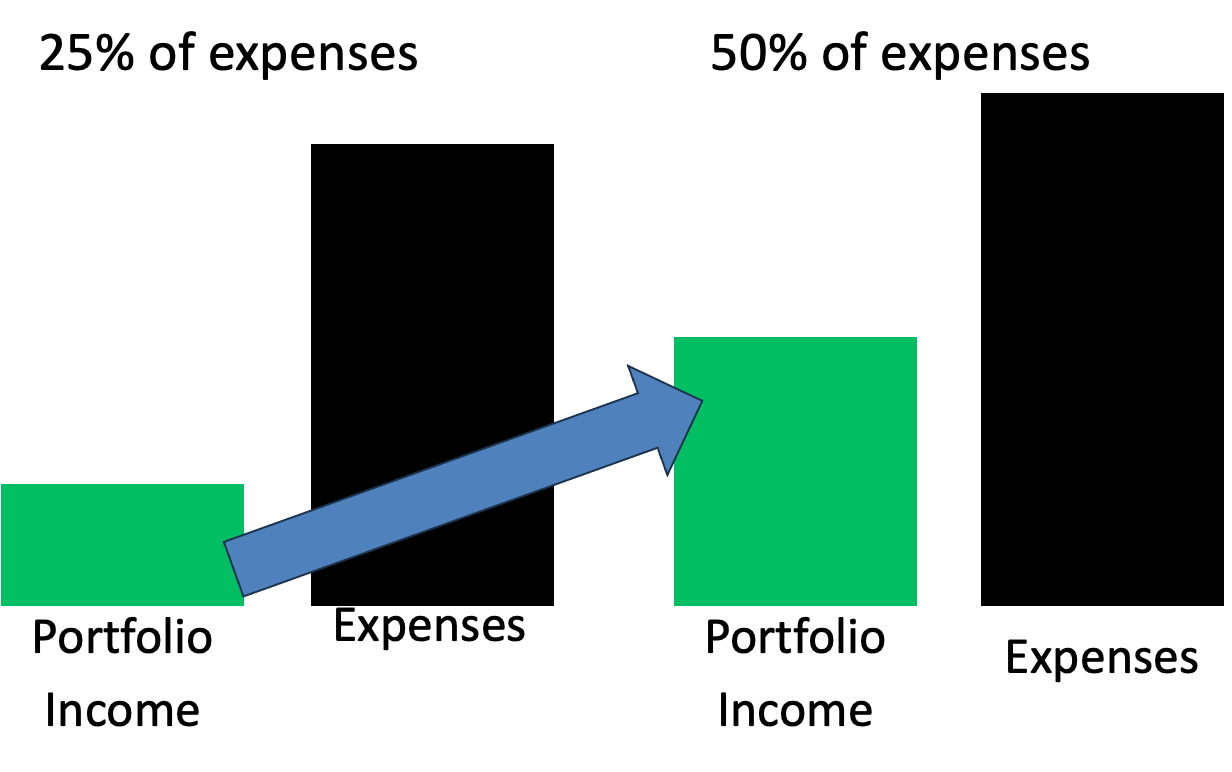

Right. So some of them, such as maybe your passive income is equal to 25% of your expenses, or even 50% of your expenses. and you know that as you continue along maybe the nest egg earnings are as much as what you are contributing annually. That might happen a little bit earlier. Think about when we started talking about F.I.R.E. If you have a household income of $100,000, taking $10,000 and putting that into your investments. And so at some point your portfolio is going to be earning $10,000, which is what you are already contributing. So it’s kind of fun to see your portfolio working as hard for you as what you are contributing.

Harland

There are lots of milestones that you might think up for yourself, and we’ll look at that next week a little bit in that plan that you’ll develop there. But it’s really up to you. We’ve just suggested a few of them here: get to 25% of your expenses, or 10% of your expenses, whatever it is, pick your own milestones along the way.

Mike

And then as you get closer to achieving F.I.R.E., we’ll see where the nest egg is able to produce cash flow exceeding your expenses. And then when your cash flow exceeds your earned income, and that’s even better. You have to determine your own milestones, look for them, and then celebrate them when you get there.

Harland

That’s right. So today was about milestones. It’s a long way, perhaps, to that financial independence, but pick some spots along the way, even just putting your first dime in the Piggy Bank, achieving 10% of your income, say whatever it is, and celebrate those milestones along the way.

Next week. What are we going to be doing next week, Mike?

Mike

Next week we’ll be talking about creating a vision of what you want your life to be like when you achieve F.I.R.E. And then, what’s your life going to be like between now and then? What are we doing to create this life of freedom?

Harland

Yeah. And so that’s where we’ll go next week. How you might really start to put this in writing to get that vision of where you’re going, to get a sense of commitment to to live in a certain way between now and then. And then to achieve that finish, get to the end, get that financial independence that you want to get. So we’ll see you next week. But mark those milestones along the way.

See you, Mike.

Mike

Harland, thank you. And thanks everyone for listening.

HELP US GET TO KNOW YOU BETTER

Join us at noon Eastern time on the third Wednesday of each month as multi-family investors network and engage in conversations about how to be better investors. We discuss opportunities and what we are doing in the current market. Watch for the Zoom link if you have subscribed to the blog.

Attune Investments provides a better return for our investors. And we make a positive impact in people’s lives and in our world.

If you want to learn more about how others are investing with us then we invite you to join our club and request a conversation with us. See below.

Through the power of a syndication partnership with other investors like you, working with managing partners who are experienced in managing apartment complexes, you can own multifamily assets.

Or you can choose to loan money, get in with a clear return, and get out earlier.

If you haven’t already subscribed to our BLOG, you can increase your knowledge and comfort with this asset class by subscribing now. It’s free. We publish an article every week. SUBSCRIBE HERE And take one more step. Become a member of our ATTUNE INVESTORS CLUB in which you have more personal access to us. JOIN HERE.

Mike is a retired aerospace engineer with a passion for real estate investing and teaching financial literacy. He lives with his wife in Daytona Beach, Florida.